40+ co signing for a mortgage pros and cons

Peace of mind for new homeowners since they know. Although there are advantages --.

Product Discovery And Delivery Insights By Nomtek

Lower credit score requirements.

. Web The Pros and Cons of Co-signing a Mortgage We sorted the pros and cons of being a co-signer into three common scenarios. If youre considering cosigning your main motivation should be helping someone buy a home. Highest Satisfaction for Mortgage Origination.

Apply Online Get Pre-Approved Today. Your co-signer could end up facing serious. Heres the place to start.

Ad Compare Best Mortgage Lenders 2023. Your access to credit may be affected. Web Cosigning a mortgage involves taking on a lot of risk with little financial upside.

If you have a friend or family member who really wants a house but doesnt qualify. You have no ownership interest in the property and dont hold the title. Web A co-signer cannot help to reduce the minimum down payment requirement but they can contribute to the total down payment if they wish.

Real estate is always changing. Web Cosigning on a mortgage loan is a risky endeavor because you guarantee monthly payments without actually getting any equity in the mortgage. If things go well.

They can also help you. Web Cosigning for someone means youre taking responsibility for the loan lease or similar contract if the original borrower is unable to pay as agreed. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Easier for potentially unqualified mortgage applicants to secure a mortgage. The reason why a primary borrower may be able to qualify for a loan with a co-signer when unable to do so alone is because the co. Ad You want a local real estate agent whos best for you right.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Your debt-to-income ratio will increase affecting your. The long-term risk of co-signing a loan for your loved one is that you may be rejected for credit when you want it.

Web Having a co-signer helps borrowers with lower credit boost their ability to obtain a loan as long as the co-signer has a stronger financial profile. Compare Apply Directly Online. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

Apply Online To Enjoy A Service. Web Some cons for the co-signer are. Co-signer could be sued.

Web PROS Pros of Co-signing a Mortgage. Web The co-signers responsibilities will continue as long as the loan lasts - which may be 30 years. Web Pros and cons of co-signing a mortgage Pros.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Pros and Cons of Co-signing a Mortgage As we discovered earlier there are mixed opinions on the concept of mortgage co-signing. Work with a full-time agent who will help guide you.

Contemporary Computational Applications And Tools In Drug Discovery Acs Medicinal Chemistry Letters

Does Co Signing Affect In Buying Home In The Future

:max_bytes(150000):strip_icc()/how-many-hours-a-week-is-full-time-employment-2063404-FINAL2-edit-edc3c79826344bfebc4b3007579b1680.jpg)

How Many Hours A Week Is A Full Time Job

10 Best Instant Payday Loans With No Credit Check Get Online Cash Advance For Bad Credit 2022

Co Signing A Mortgage How It Works Requirements Pros And Cons

What Does Co Sign Mean Pros And Cons Of Co Signing A Loan

40 Most Notable Big Name Brands That Are Using Wordpress

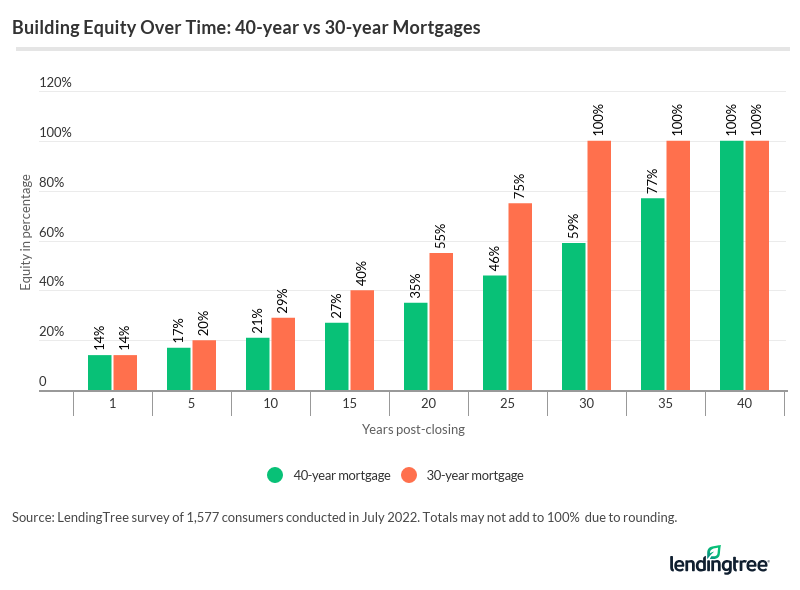

What Is A 40 Year Mortgage Lendingtree

The Pros And Cons Of Adding A Co Signer To Your Mortgage Application

Nagorno Karabakh Conflict Wikipedia

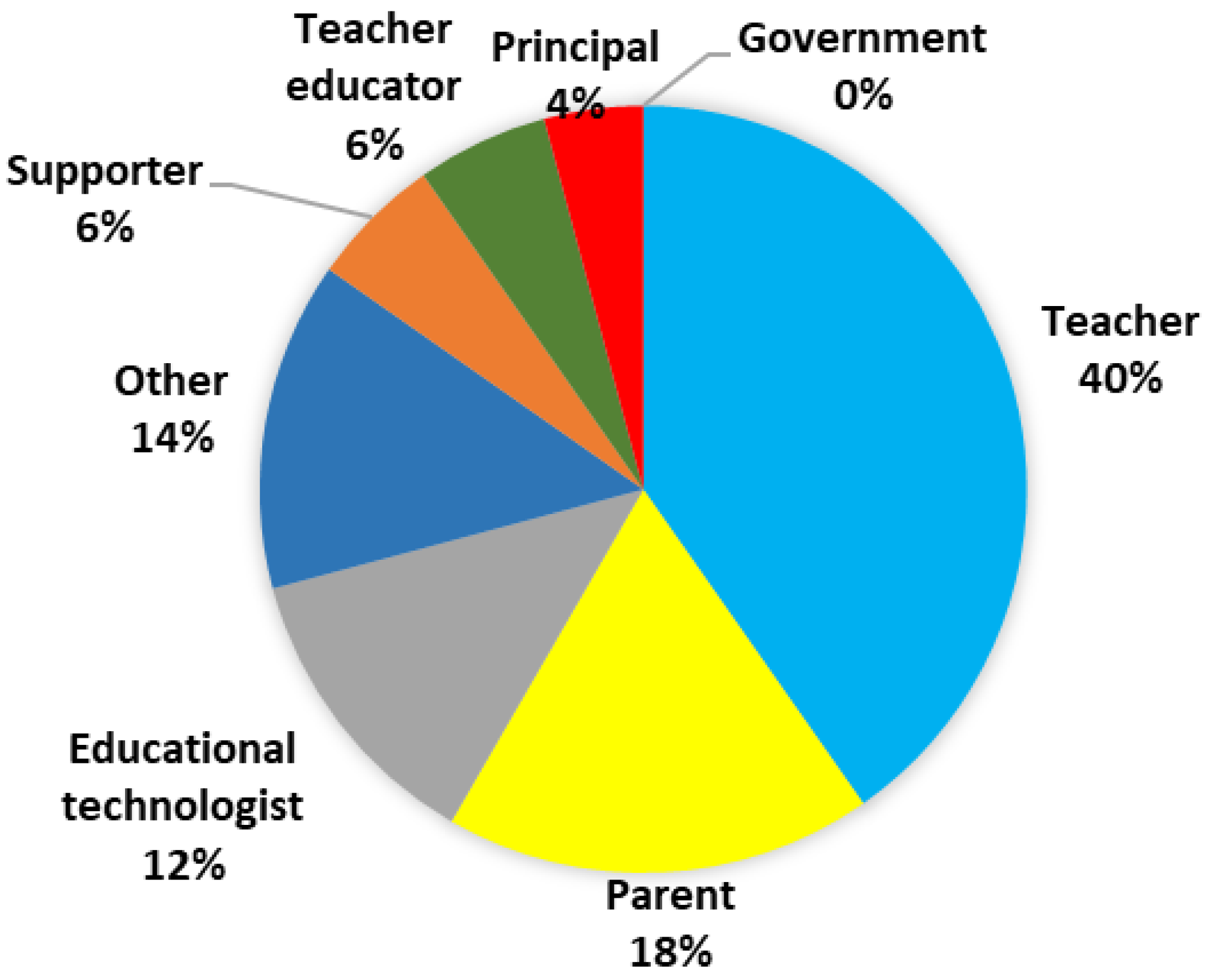

Social Sciences Free Full Text Challenges And Positives Caused By Changing Roles During Emergency Remote Education In Estonia As Revealed By Facebook Messages

The Pros And Cons Of Cosigning A Loan

Pros And Cons Of Cosigning A Loan Debt Com

About Acrylic Drums Are They Any Good What Are The Pros And Cons R Drums

Can I Get A 40 Year Mortgage Unbiased Co Uk

Guide To Piggyback Loans How A Piggyback Mortgage Works

A Comparison Of Working In A Big 4 Pros And Cons Is It Worth It